H1b paycheck calculator

Resident for federal income tax purposes if he or she meets the Substantial. Generally an alien in H-1B status hereafter referred to as H-1B alien will be treated as a US.

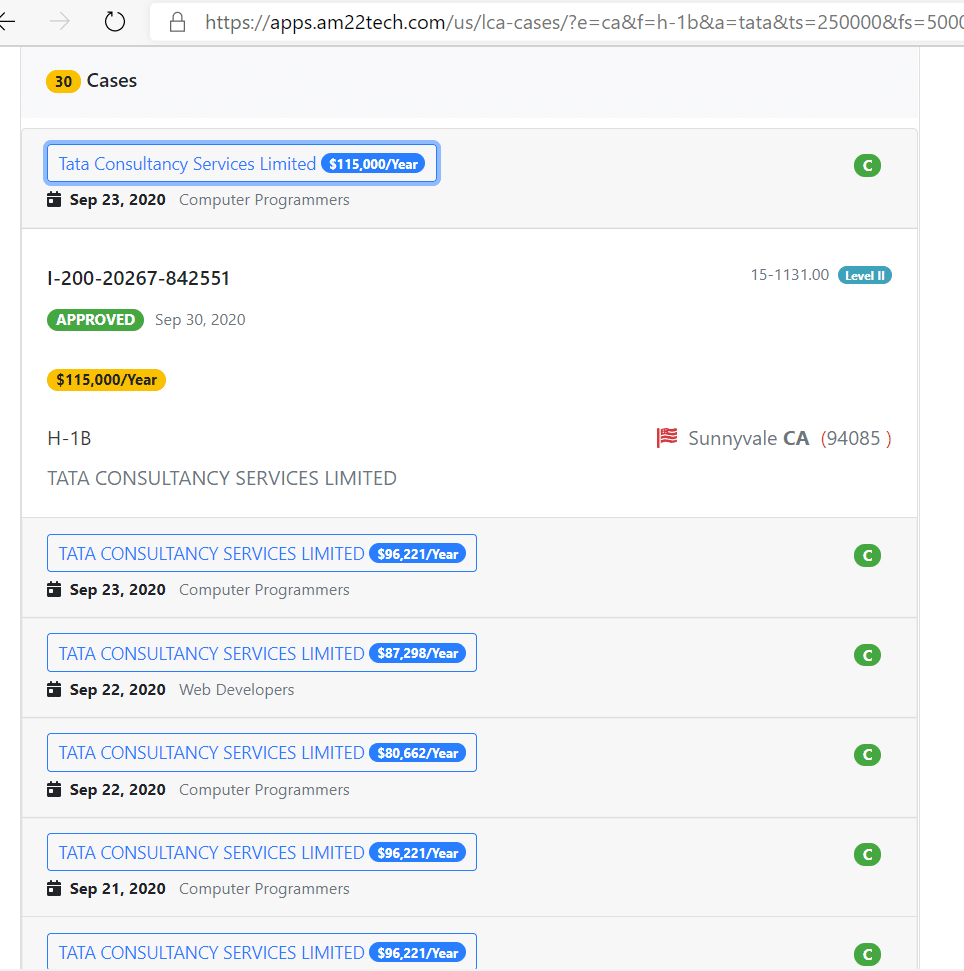

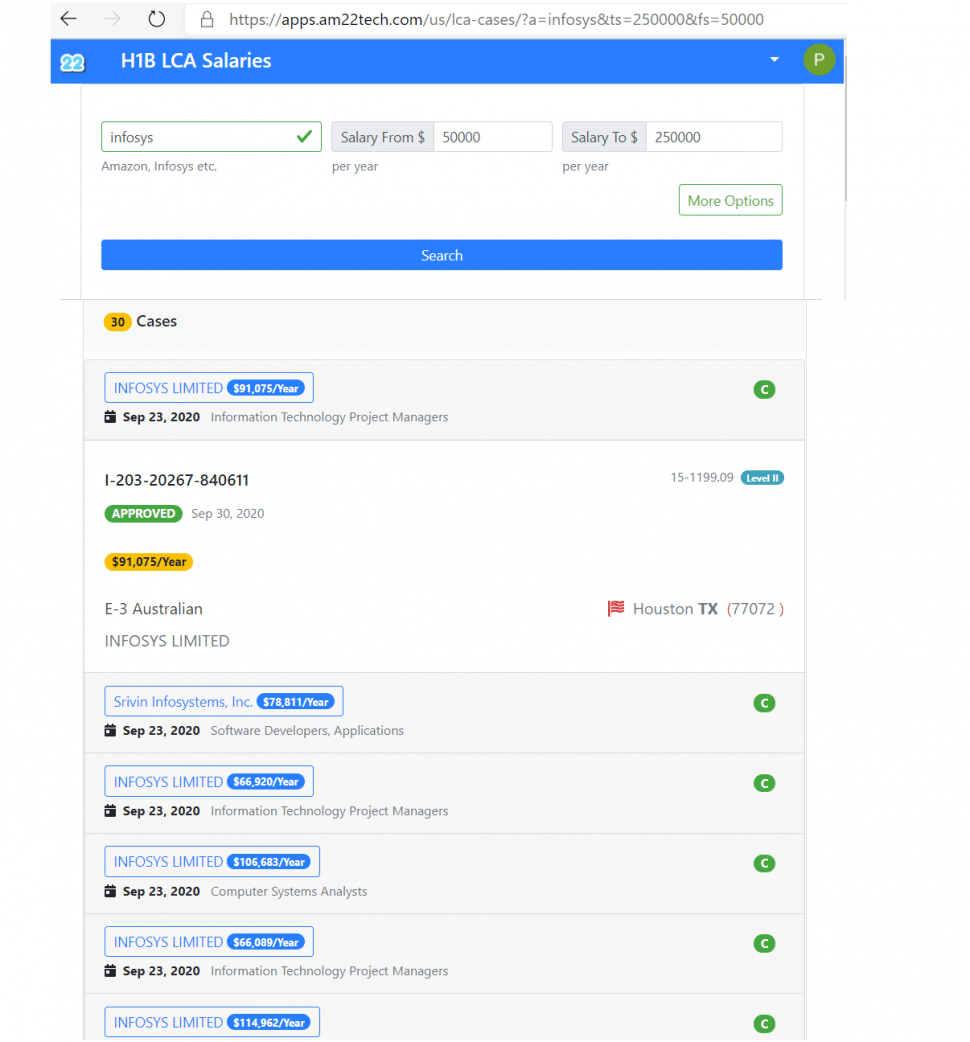

Find H1b Salaries Lca Employers Compare Estimate Usa

Texas Unemployment Insurance UI is paid on the first 9000 in wages you pay each employee every calendar year.

. Given that the second tax bracket is 12 once we have taken the. For example if an employee earns 1500 per week the individuals annual. Well do the math for youall you need to do is enter the.

There are four tax brackets that range from 259 and 450. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

Important note on the salary paycheck calculator. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into. Prevailing Wage Level Calculator for H-1B H-1B1 E-3 and H-2B Visas and PERM Labor Certification.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and. H1b visa holder salary is taxed same as any US citizen or Resident.

This money goes to the IRS where it is counted toward your annual income taxes. Federal Salary Paycheck Calculator. They pay Federal state SSN Medicare and any other taxes applicable.

Make Your Payroll Effortless and Focus on What really Matters. Ad Compare 5 Best Payroll Services Find the Best Rates. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

As an H1B worker in the US you can expect to pay between 20-40 of your wages in federal and state and local taxes depending on your income level. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. This comes to 102750.

Calculate your Arizona net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Arizona paycheck. FY 2022 Q2 October 1 2021 - March 31 2022 Data Files processed and available in. Your tax rate is calculated using several factors and can change each.

These taxes will include. Besides FICA taxes you will see federal income taxes are also taken out of your paychecks. H1BSalaryOnline portal indexed 10 Million Labor Condition PERM Applications from 2001 onwards.

How much are H-1B visa holders taxed in California. Given that the first tax bracket is 10 you will pay 10 tax on 10275 of your income.

Uscis Withdraws Wage Levels Based H1b Lottery Rule Why 2022

H1b Lottery Chances What H 1b Lottery Results Say About Odds 2022

California Paycheck Calculator Smartasset

How To Find A Job Using An H1b Database The Top H1b Databases 2022

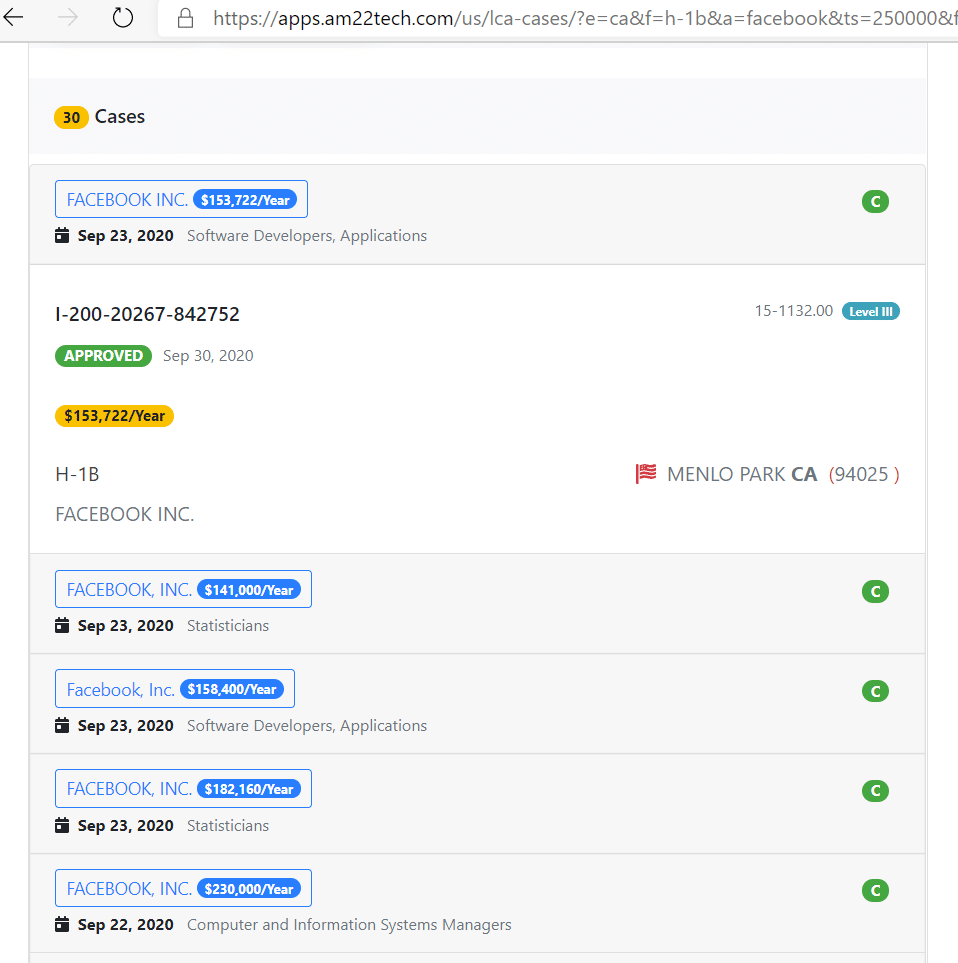

Find H1b Salaries Lca Employers Compare Estimate Usa

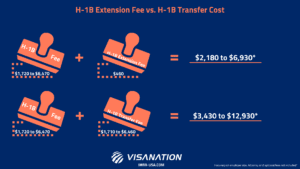

Ultimate Guide To H1b Fee How Much Who Pays 2022

Credit Karma H1b Visa Comparably

Find H1b Salaries Lca Employers Compare Estimate Usa

Schlumberger H1b Visa Comparably

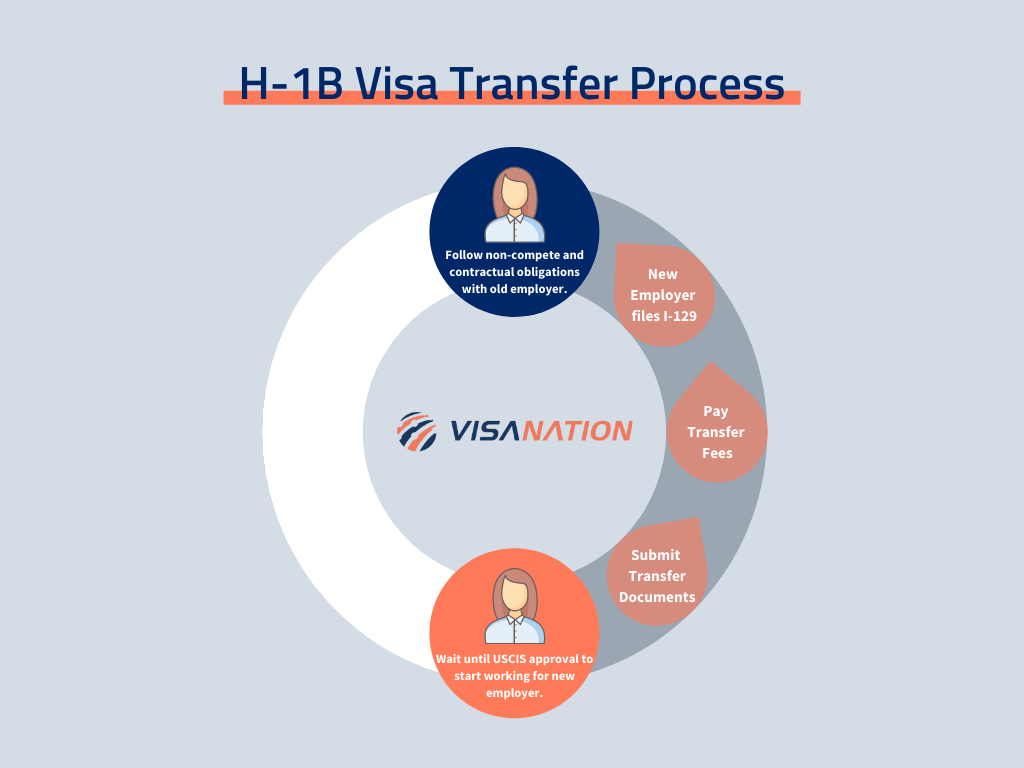

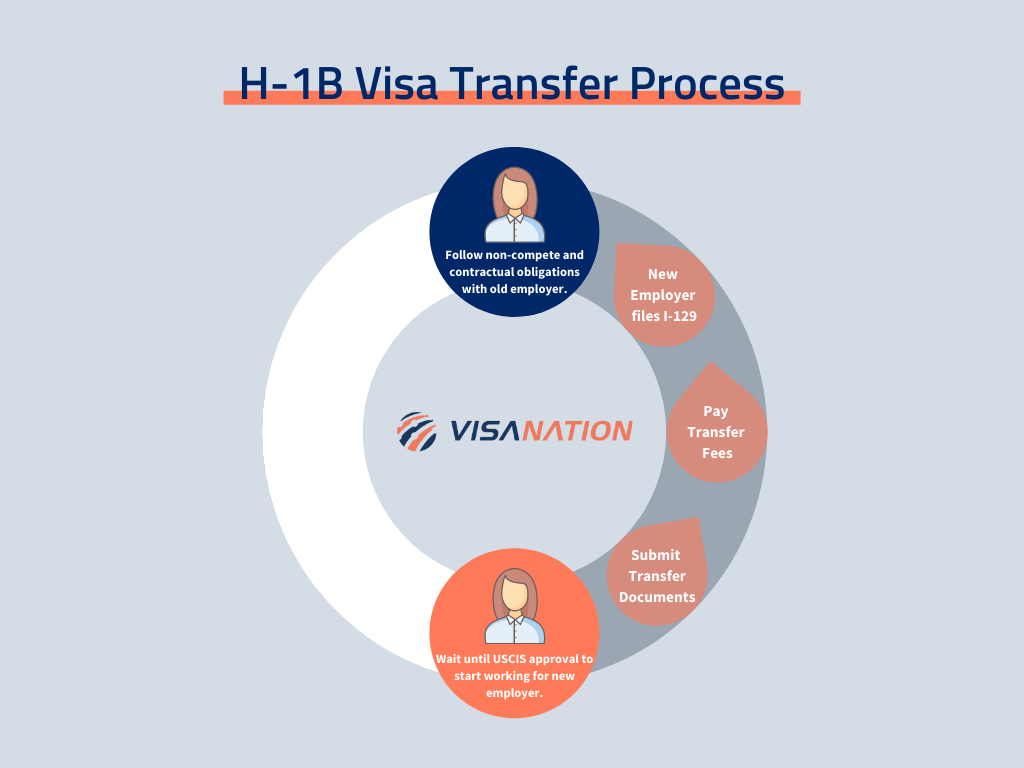

H 1b Visa Transfer Process Documents Fees 2022

The O1 Visas An Alternative To H1b For Stem Opts Visa Peer Group Client Relationship

Us Tax Filing 2022 For 2021 H1b L1 H4 L2 Updates Deadline Rates E Filing Redbus2us

Find H1b Salaries Lca Employers Compare Estimate Usa

H 1b Fees Who Pays For What And How Much Updated 3 28 22

Am22tech Usa Australia Canada Immigration Visa Money Green Card Application Visa Academic Essay Writing

H1b Salary Comparably

H1b Salaries When To Trust The Data And When To Ask More Questions