Calculating student loan payments fannie mae

Student Loan Payments. And student loan payments as well as your total monthly housing payment.

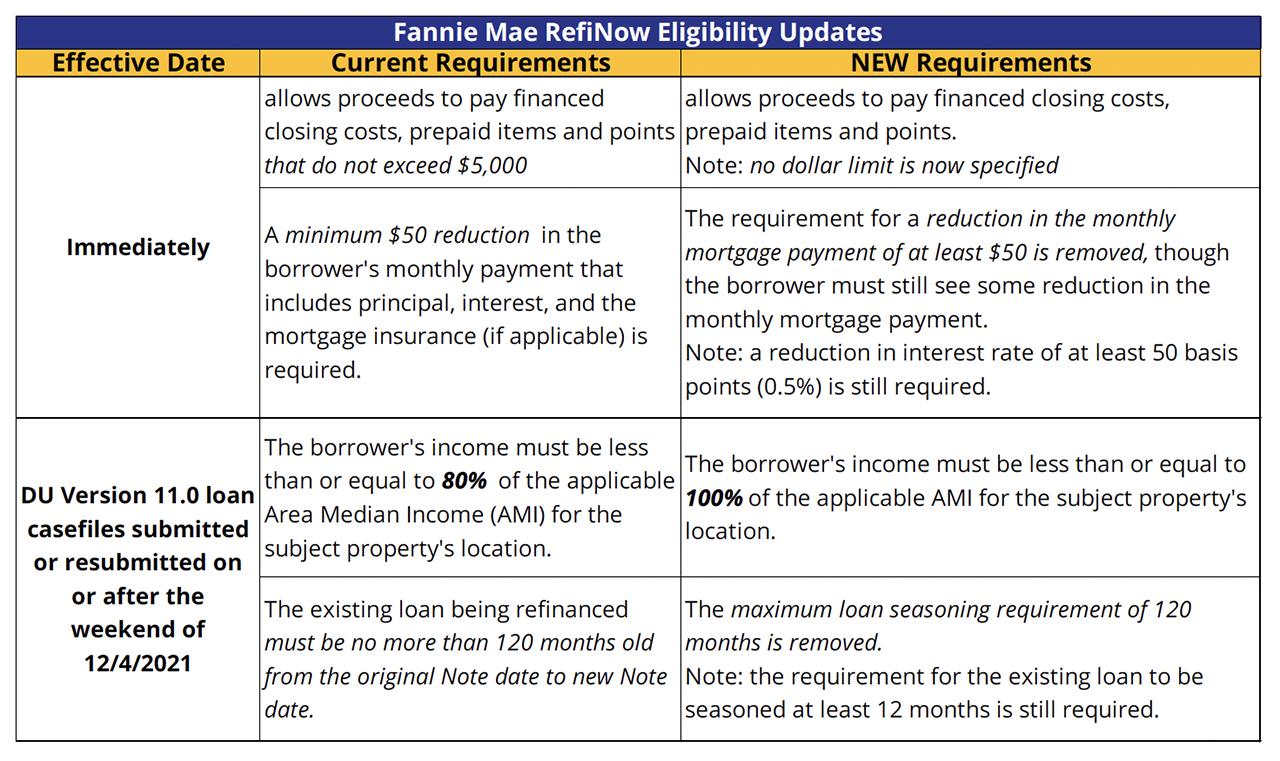

21 92 Fannie Mae Ll 2021 10 Expanding Refinance Eligibility With Refinow Pcg

Assets-Bank Accounts Retirement and Other Accounts You Have.

. It makes sense since. Calculating Deferred Loan Payments. Fannie Mae customers.

Trying to qualify for a home mortgage can get a little sticky if you have a large number of outstanding student loans. These institutions develop standards for among other things the loan-to-value ratio borrowers credit score requisite documentation and a maximum baseline limit for mortgage amounts. Calculating your debt-to-income ratio.

Let our professional writers handle your. The Fannie Mae Form 3200 is a common form used for promissory notes on fixed-interest mortgages although there are other options out there. This means that when you calculate your student loan payments your other payments ie.

As a busy student you might end up forgetting some of the assignments assigned to you until a night or a day before they are due. The payments on a federal income tax installment agreement can be excluded from the borrowers DTI ratio if the agreement meets the terms in Debts Paid by Others or. How are student loan payments calculated if the monthly income-driven repayment plan is 0.

When the mortgage that will be delivered to Fannie Mae also has a home equity line of credit HELOC that provides for a monthly payment of principal and interest or interest. Derogatory Student Loan Debt Scenario. 50 VA loans.

As long as the lender can provide documentation showing the IDR payment is 0 they can qualify the borrower with 0 for the monthly qualifying payment. Conventional loans backed by Fannie Mae and Freddie Mac. A conforming loan is a mortgage that complies with the guidelines established by the government-sponsored entities GSEs Freddie Mac and Fannie Mae.

Clarification and New Policy for Student Loan Debts and Obligations PURPOSE. Other monthly debt payments. Student Loan Refinance.

If youve applied for a credit card mortgage or car loan you probably know that you have a FICO scoreHowever what you may not realize is that you likely have more than one FICO score. Financial Information Assets and Liabilities 2a. Business-related debt for which the borrower or co-borrower is personally obligated would likely be on their credit report and therefore already included in the debt-to-income DTI ratio.

To qualify for a conforming loan most lenders require a DTI of 43 or lower. Fannie Mae and Freddie Mac Government-Sponsored Enterprises GSE which package residential mortgages into securities allow higher debt levels for homebuyers with a significant student debt load. Fannie Mae does not require lenders to review or document income from secondary sources when that income is not needed to qualify.

Back-end DTI limit. On Wednesday September 07 2022 the current average 30-year fixed-mortgage rate is 602 increasing 8 basis points over the last week. The purpose of this circular is to clarify and explain new policy regarding student loans for the underwriting of Department of Veterans Affairs VA guaranteed home loans.

Conventional Loan 3 Down Available Via Fannie Mae Freddie Mac. The most common type of loan for home buyers is a conforming mortgage backed by Fannie Mae or Freddie Mac. A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination.

When you take out a mortgage to buy a home the home itself is what is used as. Calculating a Student Loan Repayment. When you apply for credit lenders evaluate your DTI to help determine the risk associated with you taking.

Thank you so much. Circular 26-17-1 - January 13 2017 - New Electronic Upload of Prior Approval Loan Submissions. Fannie Mae conventional is now your only IBR option in 2018.

No max DTI specified but borrowers with higher DTI could be subject to additional scrutiny. Student loan is in collection or garnishment. How are student loan payments calculated if the monthly income-driven repayment plan is 0.

When the mortgage that will be delivered to Fannie Mae also has a home equity line of credit HELOC that provides for a monthly payment of principal and interest or interest. Second mortgage types Lump sum. This was exactly what I needed.

Credit cards auto etc and then your new housing payment ideally these numbers would fall at below 43 percent of your income. Generally a good rule of thumb for how high your debt ratio can be including your student loan payments is 43. In addition to your credit score your debt-to-income DTI ratio is an important part of your overall financial healthCalculating your DTI may help you determine how comfortable you are with your current debt and also decide whether applying for credit is the right choice for you.

Instructions for Completing the Uniform Residential Loan Application Uniform Residential Loan Application Instructions 4 Freddie Mac Form 65 Fannie Mae Form 1003 URLA Effective 92020 Instructions Revised 32020 Section 2. Conventional Loan 3 Down Available Via Fannie Mae Freddie Mac April 8 2015 3 Down payment mortgages for first-time home buyers April 21 2022 Do bi-weekly mortgage programs pay your mortgage. This might be very stressing due to inadequate time to do a thorough research to come up with a quality paper.

On Form 3200 the mortgage payment amount and due date are shown in Section 3 Payments. If your payments are deferred or the loan is in forbearance you must use 1 of the loan balance when calculating your debt to income ratio. Fannie Mae allows lenders to use one of two methods when determining the required payment on a deferred loan.

45 to 50 FHA loans. Second mortgages come in two main forms home equity loans and home equity lines of credit. Comparison of Education Advancement Opportunities for Low-Income Rural vs.

The payments on a federal income tax installment agreement can be excluded from the borrowers DTI ratio if the agreement meets the terms in Debts Paid by Others or. FHA student loan guidelines allow for IBR payments. Underwriters can take 050 of outstanding student loan balance on deferred student loans.

Even though this payment could be deferred for several years Fannie Mae wants lenders to make sure the borrower can afford the mortgage payment with the student loan. HUD came up with updated student loan guidelines where they now accept. Total outstanding balance of all student loans.

Your student loan debt will be 050 with Freddie Mac and Fannie Mae of your student loan balance to use as a monthly payment. Achiever Papers is here to save you from all this stress. Urban High School Student.

A borrower who earns 70K a year but has student loan payments a high car payment and high credit card payments might qualify for a much smaller loan than a borrower with the same salary and. Todays national mortgage rate trends. Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially.

How To Qualify For A Mortgage With Student Loan Debt Mortgage Blog

Guidelines Changes On Student Loans For Conventional Fannie Mae Usda Fha And Va Mortgage Loans In Kentucky Mortgage Loans Student Loans Va Mortgage Loans

Fannie Mae 2022 Rules For Student Loan Payments Are Calculated In Your Debt To Income Ratio Arrivva

Fannie Mae Revised Guidelines For Student Loans Debt Payment And Refinances Greenway Mortgage Blog

B3 6 05 Monthly Debt Obligations 05 04 2022

2

How Income Based Repayments On Student Loans Affect Your Mortgage

2

2

Fannie Mae Guidelines For Calculating Student Loan Deferment Mortgage Info

2022 Guide To Qualifying For A Mortgage With Student Loans Find My Way Home

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages Effective On 9 18 21 Fannie Mae Announced That Their Automated Underwriting System Will Now Take An Average Of The

Getting A Mortgage While On Income Based Repayment Ibr

Fannie Mae Loan Purchase Letter Faqs Know Your Options

Fannie Mae Student Loan Guidelines Find My Way Home

Fannie Mae Mortgage Student Loans Find My Way Home

Student Debt Whose Homeownership Rate Does It Hurt Most Fannie Mae